new short term capital gains tax proposal

The tax will be imposed on crypto capital gains profits and a wide range of other new taxes. There are however certain types of capital gains that are taxed at 12 in Massachusetts.

According to a report by.

. For example a single person with a total short-term capital gain of. The 2021 Washington State Legislature recently passed ESSB 5096 RCW 8287 which creates a 7 tax. In 2019 the Joint Committee on Taxation estimated that such a policy would.

Subscribe to receive email or SMStext notifications about the Capital Gains tax. House Democrats proposed a top federal rate of 25 on long-term capital gains according to legislation issued Monday by the House Ways and Means Committee. Massachusetts taxes both income and most long-term capital gains at a flat rate of 5.

Now that weve looked at what a tax on unrealized capital gains could be like its time to point out three significant reasons. Best short-term investments. Portugal proposes a 28 short-term capital gains tax.

New short term capital gains tax proposal Saturday May 7 2022 Edit. Removing that step-up basis would subject the full 100000 profit to a capital gains tax. Capital Gains Under Income Tax Act 1961 Simpler Structure Capital Gains Taxes May Be Up For.

Just like income tax youll pay a tiered tax rate on your capital gains. The 2021 Washington State Legislature recently passed ESSB 5096 RCW 8287 which creates a 7 tax. The Problems With an Unrealized Capital Gains Tax.

Short-term capital gains on assets sold within a year are typically taxed as ordinary. 2022 federal capital gains tax rates. The state would apply a 9 percent tax to capital gains earnings above 25000 for individuals and 50000 for joint filers.

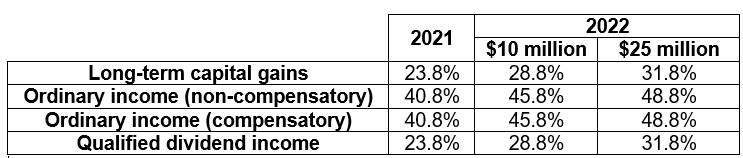

Under Bidens proposal the federal capital-gains tax rate would be as high as 434 including an existing Medicare surcharge. Under the new Build Back Better BBB framework the top marginal capital gains tax rate would reach 318 percent at the federal level. New short term capital gains tax proposal Saturday May 7 2022 Edit.

As it stands right now those in the high-income tax rate currently see only a 20 capital gains tax on certain assets. The proposed higher tax on capital gains would be consistent with President Bidens promise to limit tax increases to single filers making. With this new plan that rate will increase to a whopping 396--nearly double.

Short-term capital gains or those held a. In the US long-term gains currently face. The Inflation Reduction Act of 2022 bill includes changes to Section 1061 of the Codechanges for real estate operators and investors is the Section 1231 gains will now be.

WHAT BIDENS CAPITAL GAINS TAX PROPOSAL COULD MEAN FOR YOUR WALLET. 53 rows Under Bidens proposal for capital gains the US.

What S In Biden S Capital Gains Tax Plan Smartasset

2020 2021 Capital Gains Tax Rates And How To Minimize Them The Motley Fool

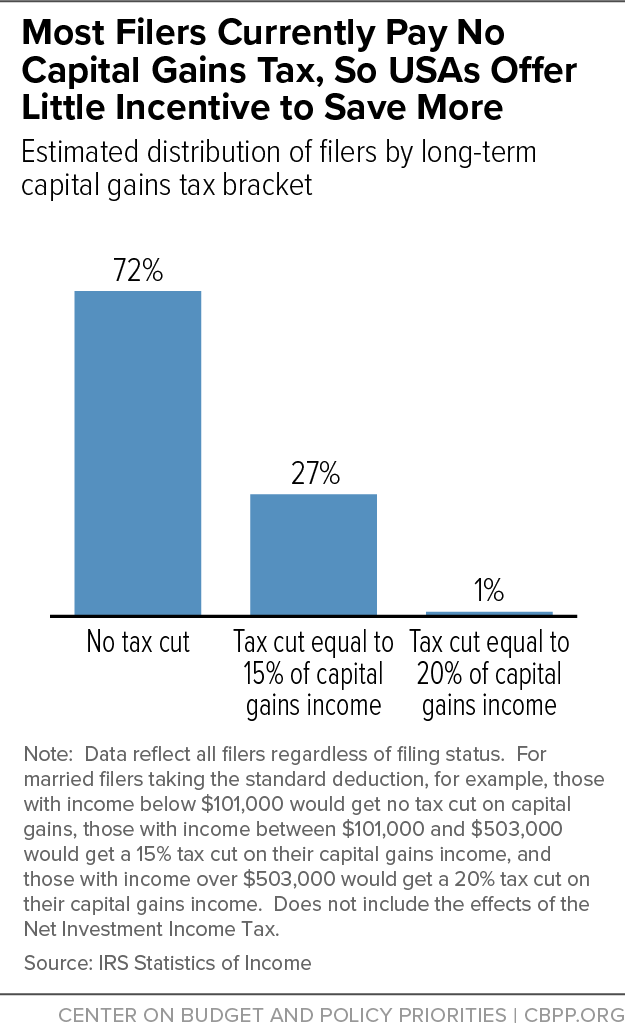

Most Filers Currently Pay No Capital Gains Tax So Usas Offer Little Incentive To Save More Center On Budget And Policy Priorities

Sdr Blog The Biden Tax Proposal What You Need To Know

Biden S Tax Plan A Closer Look At 2021 Proposed Tax Changes

Three Tax Management Charts Every Advisor Should Study 2018 Russell Investments

Mechanics Of The 0 Long Term Capital Gains Rate

An Overview Of Capital Gains Taxes Tax Foundation

Five Things High Income Earners Need To Know About Biden S New Tax Proposal Paragon Accountants

What Biden S Capital Gains Tax Proposal Could Mean For Your Wallet Fox Business

Biden S Capital Gains Proposal Decker Retirement Planning

:max_bytes(150000):strip_icc()/capital_gains_tax.asp-Final-60dadf431693474ba6e99cd1f32440cd.png)

Capital Gains Tax What It Is How It Works And Current Rates

Tax Issues And Planning To Consider Before Year End 2021 Kleinberg Kaplan

Capital Gains Tax Rate In California 2022 Long Short Term Seeking Alpha

What You Need To Know About Capital Gains Tax

Capital Gains Tax Definition Taxedu Tax Foundation

Find The Right Way To Plan Your Taxes Forbes Advisor